AUSTRIA Dec. 2021 – Q&A style article to be published in the December issue of H2 View magazine looking at Worthington Industries’ role in the hydrogen market.

H2 View: Worthington Industries has been manufacturing hydrogen high-pressure cylinders for decades out of the US and Austrian facilities. Can you tell us about Worthington’s history in hydrogen and the journey the company has been on to where it is today?

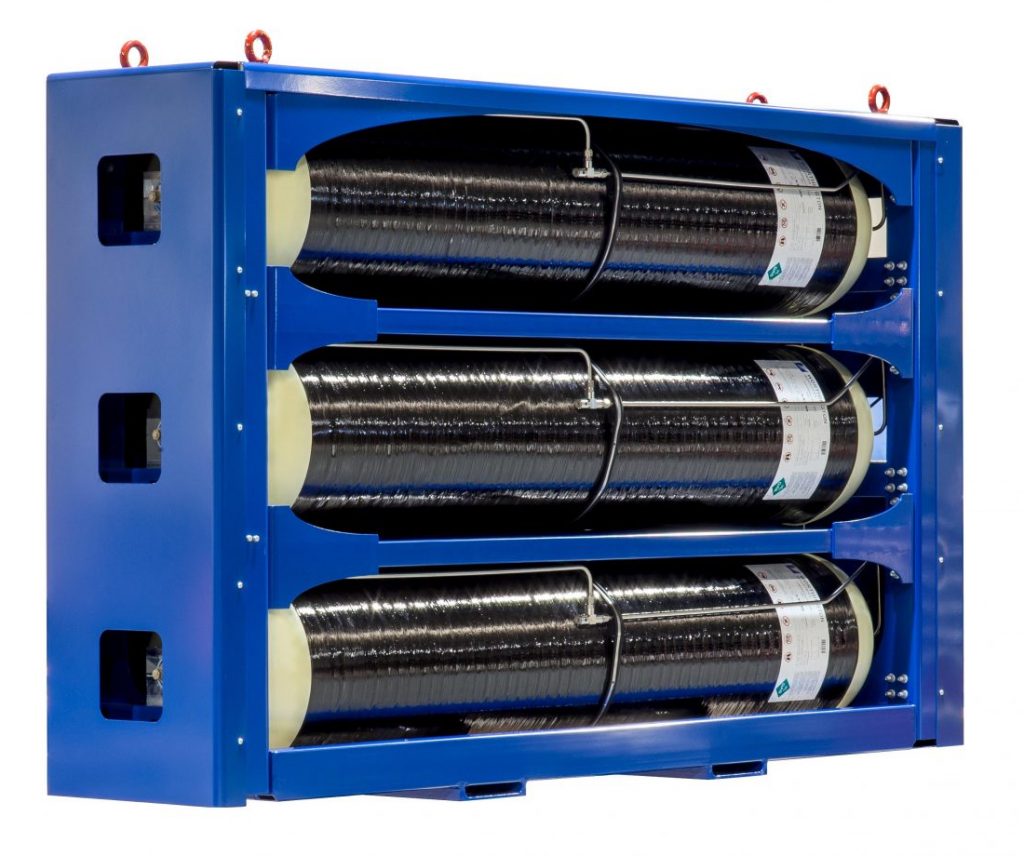

Gabi Zeilerbauer: Yes, that’s correct. Long before the automotive industry began to view hydrogen as the clean fuel of the future, we were in the hydrogen business. Primarily we partnered with industrial gas customers, designing and manufacturing gas containment solutions for the use of hydrogen in industrial processes. Depending on the operation’s scale we have provided this segment with high-pressure steel cylinders for stand-alone use, for bundles, and for multi-element gas containers (MEGCs). The segment remains interesting and important for us.

While we were serving our industrial gas customers with hydrogen containment solutions, we were building our portfolio for the alternative fuels market. Hydrogen did not yet have the traction as scalable technology in the mobility market that it has today, still about fifteen years ago, we began investing in technologies that enabled Automotive OEMs and retrofitting and conversion operations to outfit vehicles with systems that significantly reduced vehicles CO2 emissions. In Austria, we began engineering and making CNG cylinders for vehicle integration, stationary buffer storage and MEGCs since the 1980’s. Since the early 2000s, we have been supplying Volkswagen’s light-duty CNG vehicle platform as a Tier-1 supplier. In Poland, we began engineering and making products for LPG- and CNG-fueled vehicles, and we have supplied high-capacity CNG transport storage solutions.

The experience and expertise we acquired in LPG and CNG – today sometimes referred to as transition technologies – allowed a smooth knowledge transfer to H2 mobility markets. Here we supply onboard fueling systems for cars, buses and trucks as well as transport and storage solutions for hydrogen refueling stations. In the US and Europe, Worthington was among the first movers in this space and has pioneered many solutions that have helped attain the critical mass needed to prove hydrogen has staying power as a clean fuel for today and tomorrow.

H2 View: Where does Worthington fit into the hydrogen supply chain?

Ekaterina Levitskaia: Depending on the market, you can find Worthington at different positions on the supply chain. With H2 production we are in storage and distribution – we help bring H2 to where it is needed for use. When it comes to vehicle manufacturing, we are tier 1 automotive supplier delivering gas street components, high-pressure cylinders and complete onboard fueling systems. The same solutions are also in high demand on the growing retrofit market since public transport managers and logistics fleet managers often decide to convert existing vehicles while major vehicle manufacturers modify and build facilities to accommodate large-scale hydrogen-fueled vehicle production.

These two supply chains are converging at the moment so that it is not uncommon that hydrogen refueling stations built with Worthington solutions will be used to refuel commercial and eventually passenger vehicles powered by Worthington onboard fueling systems.

H2 View: We understand Worthington has invested more than €30m in new facilities and acquisitions that serve the hydrogen market in the past 18 months. Is hydrogen a big focus for the company moving forward? What can you tell us about this investment?

Radisa Nunic: In June 2021 Worthington formed the Europe-based business segment, Sustainable Energy Solutions (SES), and picked TIMO SNOEREN to head it as Vice President. This segment is focussing heavily on hydrogen, and we are taking a multi-phase strategic approach to mobility applications. Part of the strategy is to supply our customers with more than pressure vessels, which is why we bought PTEC a design and assembly center in Northern Germany that allows us to offer the engineered valves and gas-street components needed for complete systems.

When it comes to H2 for transport and travel, local and regional transport authorities are among the early adopters. This has meant primarily buses – and we have customers in Germany, Belgium and the Netherlands who are using our bus onboard fueling systems. But tram and regional train operators are also investing in hydrogen. For example, to help this development, we have outfitted a shunting locomotive in Poland with one of our systems. Right now we also are helping OEMs and retrofitting operations put more H2 heavy-duty trucks into service using behind-the-cab onboard fueling systems. The next phase will see a scaling up of hydrogen passenger vehicle production, and my team and I are partnering with OEMs to work out the best solutions for their vehicle platforms.

It’s worth pointing out that hydrogen is just one part of our company’s global approach to serve major sustainable mobility markets. As mentioned, we serve the CNG market out of Europe. In addition, Worthington just acquired Temple Steel, a global leader in the rapidly growing electrical steel market. Tempel designs and produces highly engineered, precision-stamped, electrical steel laminations used for the core of electric motors, transformers and generators. With Temple in our portfolio and Worthington’s long relationships in the automotive sector, Worthington is positioned to capture a greater share of the growing hybrid and EV market. With hybrids and EVs expected to continue growing at double-digit rates worldwide, Tempel will significantly enhance Worthington’s existing automotive offering, including light-weighting and laser-welding technologies that will bring customers lower costs and overall lower vehicle weights. Investments like these will continue so that we can deliver Europe, the Americas, and Asia with the technologies that best fit their local geographies and established infrastructure.

H2 View: What are the main challenges when it comes to transporting and storing hydrogen? What’s Worthington’s role in overcoming these challenges?

Radisa Nunic: Companies and governments are working to build and fund the hydrogen refueling station (HRS) infrastructure to make H2 a mainstream sustainable fueling option. The coverage is not there yet, though. There are also too few vehicles at an attractive price. Fortunately, the EU is addressing both of these shortfalls on a large scale.

Another challenge is that the majority of European HRSs have not been designed for heavy-duty vehicle refueling, which is counterintuitive since large commercial vehicle adoption is outpacing growth in H2 passenger vehicles. Currently, the fueling protocols for heavy duty vehicles have not been established. This needs to happen, and future HRSs need to be designed for both types of refueling – like you see at fuel stations on the Autobahn. Or in the case of logistics and transport depots, heavy-duty HRSs would suffice.

Based on the investments you mentioned earlier, we have been expanding our capacity for supplying high-pressure storage and transport solutions for hydrogen, so that we can help the whole infrastructure get past some of the bottle necks it is facing. This is currently the most economical solution both for passenger cars and heavy-duty vehicles. This will likely remain the case for the foreseeable future, and even once liquid H2 technologies begin to scale, compressed containment will remain part of the mix.

We are also active participants in H2 consortiums, and we have dedicated resources since 2020 to intensify government relations in this area.

H2 View: Worthington has been involved in hydrogen for many years already, how have you seen the market shift?

Gabi Zeilerbauer: When Worthington made hydrogen a strategic pillar over five years ago, many viewed H2 as a novelty, like a technology that would not find wide-scale applications for probably decades. A sea change has occurred in just the last 18 to 24 months. Not just governments, but private citizens are embracing the imperative to take serious action to prevent worsening climate change; and corporations are recognizing that good corporate citizenship can deliver high growth rates when coupled with investments in emerging technologies, such as the entire H2 value chain.

COVID has shown us the fragility of long supply chains. This vulnerability extends from raw and semi-finished materials to energy. H2 offers countries and regions a way to achieve energy independence on the basis of technology rather than on geography.

Hydrogen is also gaining momentum because electricity is not available in equal measure in all parts of the world. As mentioned earlier, in certain geographies hydrogen makes more sense.

H2 View: In closing, what can you tell us about Worthington’s hydrogen aspirations for 2022?

Ekaterina Levitskaia: We want to grow the Sustainable Energy Solutions business segment, so that we can help our customers decarbonize faster, generate more revenue and earn better margins. The market potential is huge. According to a 2021 Hydrogen Insights study by Goldman Sachs, over 300 billion in investments will drive 228 live hydrogen projects globally. We want our work to convince customers, consumers and investors that these numbers, as promising as they might be, are too low – that more projects are needed, and more investment merited.

—————

Worthington Industries Europe Company Description

Europe is home to Worthington Industries’ Sustainable Energy Solutions business, which is dedicated to offering on-board fueling systems and services, as well as, gas containment solutions and services for the storage, transport and distribution of industrial gases supporting the growing hydrogen ecosystem and adjacent sustainable energies like compressed natural gas. Worthington incorporates sustainable practices into its long-term business strategy and is the first in its industry to bring Cradle to Cradle Certified™ products to market. The Company is the largest designer and manufacturer of pressure vessels in Europe with over 1,600 employees working at facilities in Austria, German, Poland, and Portugal. With the lightest composite and steel low- and high-pressure cylinders available, Worthington Europe designs and makes solutions for alternative fuels, industrial gases, and technical gases.

Worthington Industries (NYSE:WOR) is a leading industrial manufacturing company delivering innovative solutions to customers that span many industries including transportation, construction, industrial, agriculture, retail and energy. Worthington is North America’s premier value-added steel processor and producer of laser welded products; and a leading global supplier of pressure cylinders and accessories for applications such as fuel storage, water systems, outdoor living, tools and celebrations. The Company’s brands, primarily sold in retail stores, include Coleman®, Bernzomatic®, Balloon Time®, Mag Torch®, Well-X-Trol®, General®, Garden-Weasel®, Pactool International® and Hawkeye™. Worthington’s WAVE joint venture with Armstrong is the North American leader in innovative ceiling solutions.

Headquartered in Columbus, Ohio, Worthington operates 53 facilities in 15 states and seven countries, sells into over 90 countries and employs approximately 8,000 people. Founded in 1955, the Company follows a people-first philosophy with earning money for its shareholders as its first corporate goal. Relentlessly finding new ways to drive progress and practicing a shared commitment to transformation, Worthington makes better solutions possible for customers, employees, shareholders and communities.

Safe Harbor Statement

The Company wishes to take advantage of the Safe Harbor provisions included in the Private Securities Litigation Reform Act of 1995 (the “Act”). Statements by the Company which are not historical information constitute “forward looking statements” within the meaning of the Act. All forward-looking statements are subject to risks and uncertainties which could cause actual results to differ from those projected. Factors that could cause actual results to differ materially include risks, uncertainties and impacts described from time to time in the Company’s filings with the Securities and Exchange Commission, including those related to COVID-19 and the various actions taken in connection therewith, which could also heighten other risks.