January 2023, Austria – Worthington Industries’ perspective on H2 strategies and the molecule’s future potential.

The fact that hydrogen is a naturally occurring element that can be produced in a clean and green way is no secret. Although it cannot be the only solution, hydrogen has great potential to reduce carbon dioxide emissions in industry, as well as to power vehicles, heat homes, etc. Current production methods of green hydrogen, compared to blue, pink or gray hydrogen, are still expensive today, and there is still a lack of hydrogen fueling station infrastructure as well as vehicles. Consequently, hydrogen will become even more valuable when its production methods are more energy efficient. On the way to green and 100% sustainable hydrogen, various alternative and intermediate production methods have emerged, each trying to reduce CO2 intensity. Thus, in addition to green hydrogen, there is a difference between gray hydrogen (also: black, brown), turquoise hydrogen, pink hydrogen (also: yellow) and blue hydrogen.

The production of hydrogen is difficult without sufficient power supply; therefore, it is critical to build power generation facilities for this process. In 2012, 98% of the hydrogen produced worldwide came from fossil natural gas, and the steam reforming process causes CO2 emissions and entails costly carbon capture. Fortunately, research with more efficient and clean energy sources such as solar and wind power continues to develop at a rapid pace – just in time to support growing industrial applications for hydrogen. In this area, policymakers are called upon to act urgently when it comes to accelerating approval procedures for investments in the expansion of renewable energy generation. Only in this way can Austria reduce its dependence on fossil fuels more quickly.

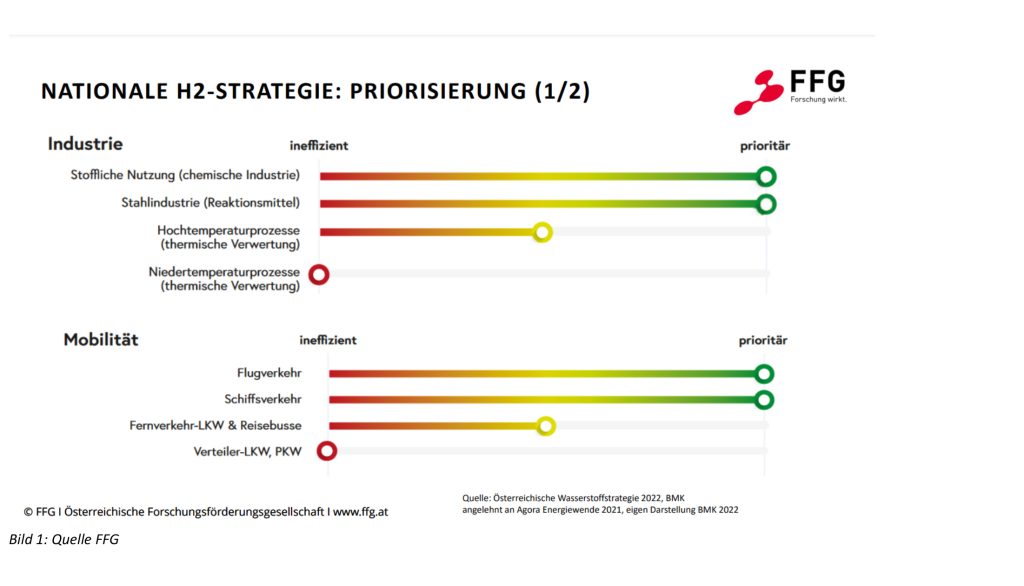

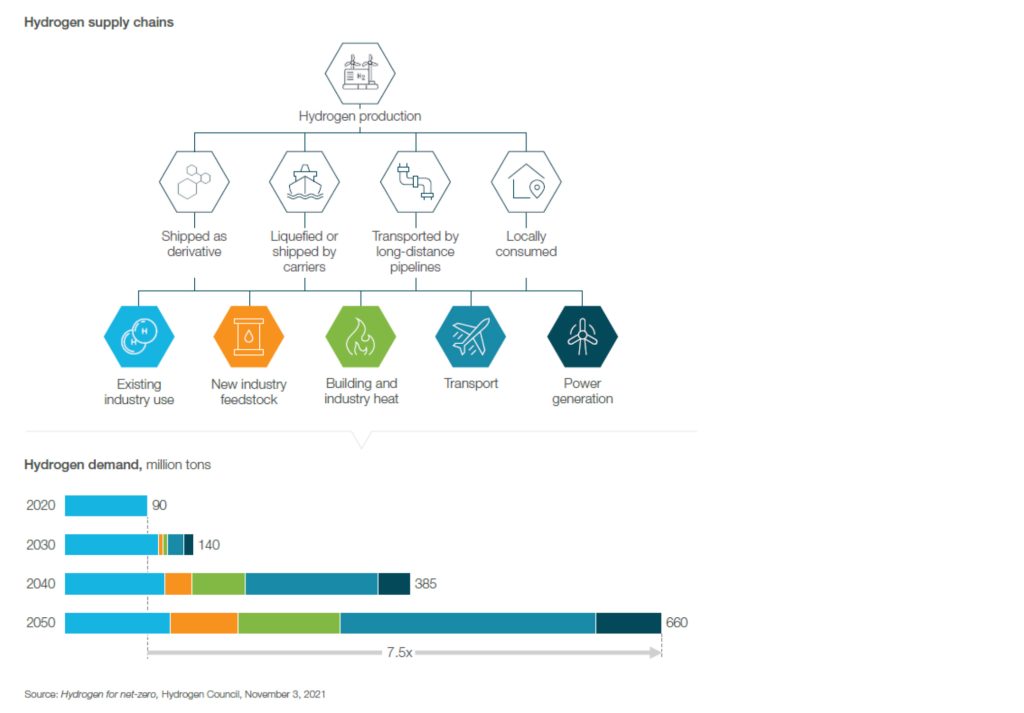

Austria’s National Hydrogen Strategy, presented in June 2022, came rather late and was not thought through to the end. Rightly, the energy-intensive industries were identified as the top priority for decarbonization, but hydrogen mobility – especially distribution trucks, passenger cars, long-distance trucks and coaches – was identified as lacking efficiency (see below Figure 1: Source FFG). In our opinion, this is too short-sighted. The global organization “Hydrogen Council” has a similar view and has identified major advantages for the transportation sector in hydrogen. However, these advantages first become viaable in 2030 (see Figure 2: “Hydrogen Supply Chains / Hydrogen Demand” below). As a result, Austria could potentially miss out on billions of dollars of investment, as there are few incentives for companies to invest in hydrogen refueling stations and vehicles. Without investment security, and especially without uncomplicated access to subsidies, Austrian companies will not develop an appetite for hydrogen.

Johannes Schneider, an expert for industrial goods and energy supply companies at Strategy & Austria, has a similar view (see profile article): “With the volumes that can currently be safely sold, green hydrogen cannot yet be produced at competitive prices. This in turn discourages large-scale consumers from converting their plants and also prevents investments in large-scale electrolysis plants. Solving this chicken-and-egg problem is a prerequisite for helping the hydrogen economy achieve a breakthrough in Austria,” says Schneider.

Figure 1: Source FFG

Figure 2: „Hydrogen Supply Chains / Hydrogen Demand“

Another sector of the hydrogen strategy which is seen as inefficient is space heating. Especially in countries with long winters, new opportunities are opening up to decarbonize heating systems (space heating). This is called “Home Power Solutions”, where each house/building produces its own hydrogen over the summer months and converts it into heat (air source heat pumps) in winter via a fuel cell & battery solution. Countries like Japan are investing heavily in SOFC technologies (Solid Oxide Fuel Cells) which are not only powered by hydrogen but also by other hydrogen containing alternative fuels like biogas or RH2 – the end product is heat and electricity. In Japan, there are now well over 300,000 installed units (as of Nov. 2019 Figure 3: Source Tokyo Gas).

Figure 3: Source Tokyo Gas

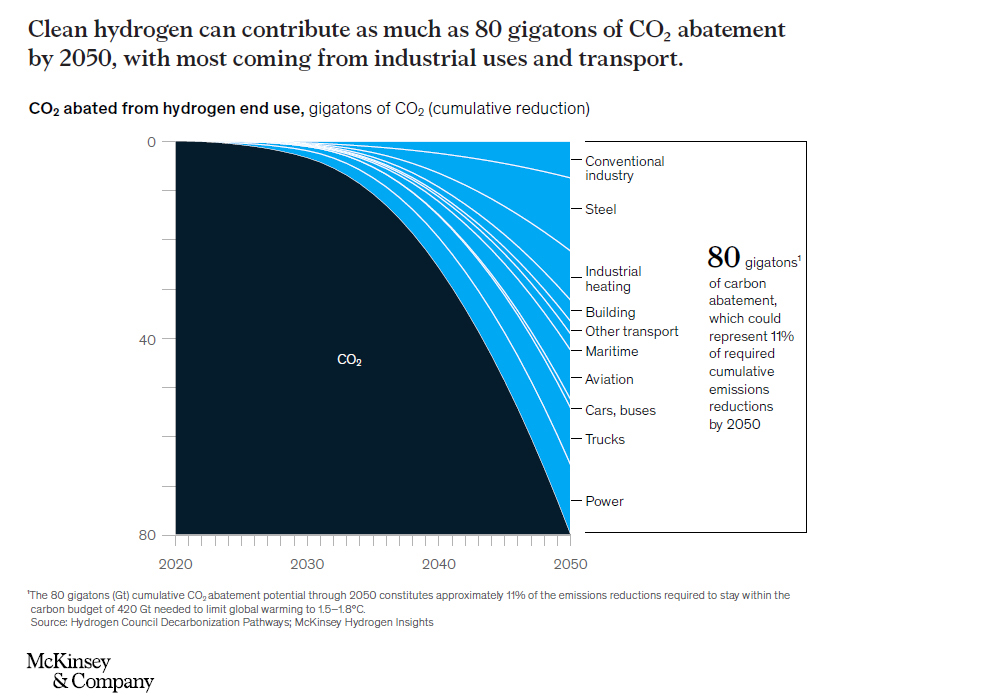

The Hydrogen Council and McKinsey predict that by 2050, it will be possible to avoid up to 20% of man-made emissions using hydrogen (Figure 4). In addition, government agencies worldwide will invest hundreds of billions of dollars to build the infrastructure needed to support this growth in hydrogen vehicles. This growth will also be fueled by increased demand for hydrogen as a fuel for vehicles, heating, and other industrial and mobility applications such as steel production or ships and aircraft. Countries with large automotive industries need abundant hydrogen to fuel their vehicle fleets. Further, more and more consumers want clean energy solutions – so they are willing to pay extra for them when buying vehicles or home heating systems. All of these factors have led to record investments in hydrogen-based technology by major companies.

The Russian invasion of Ukraine and the resulting disruption of the global economy has shown us that we need to become less dependent on fossil fuel sources. The European Commission’s REPowerEU initiative, launched in the wake of the conflict, is pursuing this very goal – to enable affordable, secure and sustainable energy for Europe – to end dependence on Russian fossil fuels before 2030. But even if hydrogen is seen as a hope for a reduction of dependence on fossil fuels, it is important not to make the same mistake when it comes to having to import the majority of the hydrogen needed in Austria because there is not enough investment, funding and demand for hydrogen in our own country.

Europe is home to Worthington Industries’ Sustainable Energy Solutions business segment, which provides on-board fueling systems and services, as well as gas container solutions and services for the storage, transportation and distribution of industrial gases, supporting the growing hydrogen ecosystem and adjacent sustainable energy sources such as natural gas.

Worthington’s European operations go beyond sustainable energy solutions, serving sectors such as medical, food and beverage, SCBA, welding and cutting, building products, outdoor living and more. The Company’s low- and high-pressure steel and composite cylinders and components that regulate gas flow can be found behind the scenes everywhere.

Our employees in Austria, Germany, Poland and Portugal work with our customers to develop gas packaging solutions that power their businesses around the world.

Figure 4

About Worthington Industries

Worthington Industries Europe is the largest designer and manufacturer of pressure vessels in the region with over 1,600 employees working at facilities in Austria, Poland and Portugal. Worthington is the first in its industry to incorporate sustainable practices into its long-term business strategy. With the lightest composite and steel low- and high-pressure cylinders available, Worthington designs and makes solutions for technical gases, industrial gases, and alternative fuels. The Company invests strategically in production facilities that serve the sustainable mobility market with gas-storage, transport and onboard fueling systems for cars, buses, trucks and more.

Worthington Industries (NYSE:WOR) is a leading industrial manufacturing company delivering innovative solutions to customers that span many industries including transportation, construction, industrial, agriculture, retail and energy. Worthington is North America’s premier value-added steel processor and producer of laser welded products; and a leading global supplier of pressure cylinders and accessories for applications such as fuel storage, water systems, outdoor living, tools and celebrations. The Company’s brands, primarily sold in retail stores, include Coleman®, Bernzomatic®, Balloon Time®, Mag Torch®, Well-X-Trol®, General®, Garden-Weasel®, Pactool International® and Hawkeye™. Worthington’s WAVE joint venture with Armstrong is the North American leader in innovative ceiling solutions.

Headquartered in Columbus, Ohio, Worthington operates 51 facilities in 15 states and seven countries, sells into over 90 countries and employs approximately 7,500 people. Founded in 1955, the Company follows a people-first philosophy with earning money for its shareholders as its first corporate goal. Relentlessly finding new ways to drive progress and practicing a shared commitment to transformation, Worthington makes better solutions possible for customers, employees, shareholders and communities.